Today, semiconductors have entered a downward cycle, but due to the wide application range of analog chip terminals, the market is not vulnerable to the economic changes of a single industry, and the market volatility is tiny. Texas Instruments, at the head of analog chips, has a different message.

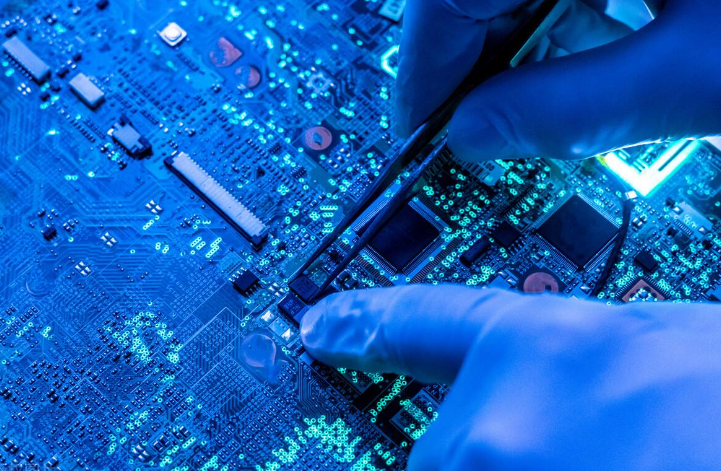

Texas Instruments' current 12-inch wafer plant starts production

On December 6, Texas Instruments (TI), the world's largest analog chip company, announced that it has begun production of analog and embedded products at its current 12-inch LFAB in Lee Hay, Utah, which TI acquired about a year ago.

LFAB is Texas Instruments' second 12-inch fab to begin producing semiconductors in 2022, providing the manufacturing capacity needed for decades to come. RFAB2, based in Richardson, Texas, began initial production in September.Here we have APEM-A4202.

Located in the heart of the SiliconSlopes community in Utah, less than an hour's drive from Salt Lake City, LFAB offers the only 12-inch semiconductor wafer facility in Utah. With over 25,548 square meters of wash room, the extremely advanced facility includes approximately 11,265 meters of automated elevated conveyer system to rapidly transport wafers throughout the fab.

Acquired by Texas Instruments in October 2021, LFAB can support 65nm and 45nm production technologies to manufacture analog and embedded products, and will expand beyond these technology nodes as needed. When completely operational, LFAB will make tens of millions of chips a day that will be used in everything from renewable energy to electric cars to electronics for space telescopes. Ti's total investment in the Lee Hai Fab will be about $3bn - $4bn.

KyleFlessner, senior vice president of TI's Technology and Manufacturing Group, said this achievement is part of the company's long-term capacity investments and additionally reinforces the company's commitment to support future semiconductor growth in the electronics sector by expanding its in-house manufacturing capabilities.

Analog chips or escape the "cold wind"?

Currently, TI focuses on developing analog chips and embedded processors, which account for the bulk of its revenue. Ti has 15 manufacturing sites around the world, including 11 wafer fabrication plants, seven assembly and test facilities, and several projection and probe facilities. Its products are primarily targeted at the industrial and automotive markets, which accounted for 62% of the company's revenue in 2021.

As the inventor of the integrated circuit, Texas Instruments' reputation was fading after decades of glory. At this time, Intel and Qualcomm entered the market. Texas Instruments turned to analog chips, an essential branch of integrated circuits, and became the market leader.

In terms of the global Analog chip market pattern, the number of overseas companies accounts for the largest proportion. In addition to Texas Instruments, there are Analog Deices, Infineon, ST, Skyworks Solutions, NXP and so on.

The downstream applications of analog chips include communication, industry, automobile, consumer and government and enterprise systems. As the manufacturing centers of end consumer goods converge to Asia Pacific and China, China has become the world's largest consumer and production market for electronic products and one of the largest markets for analog chips.

In terms of domestic manufacturers, under the continuous fermentation of domestic substitution tide, domestic enterprises such as Shengbang, China Resources Micro, Zhuosheng Micro, Jingfengmingyuan also gradually shine. Among them, China Resources Microelectronics Shenzhen 12-inch integrated circuit production line project started at the end of October, with a total investment of 22 billion yuan in the first phase, focusing on the simulation of more than 40 nm characteristic process. After completion of the project, the annual production capacity of 480,000 12-inch power chips will be formed, and the products will be widely used in automotive electronics, current energy, industrial control, consumer electronics and other fields.

Although the current consumer terminal demand is weak, the analog chip market also fluctuates with the overall cycle fluctuation of the semiconductor industry. However, due to the cyclical property of the analog chip market, driven by the downstream fields such as automobile, industry and current energy, the overall market will maintain a relatively stable growth, or avoid the cold wind of semiconductor downwind.